Emission Reporting

Navigating Emission Regulations and Reporting

A Practical Guide for Industry Leaders

In our first article, we explored the fundamentals of greenhouse gas (GHG) emissions, their sources, and their impact on climate change. We also highlighted the critical role industrial fluids play in emissions across their lifecycle. Now, we turn our attention to navigating the evolving regulatory and reporting landscape - essential for businesses aiming to stay compliant, competitive, and sustainable.

Regulatory Frameworks - Aligning with Global Climate Goals

Previously, we introduced the major emissions regulations shaping business practices today. The EU’s Corporate Sustainability Reporting Directive (CSRD), the U.S. SEC’s proposed climate disclosure rules, and emerging Asian frameworks all share a common goal: reducing emissions to help meet the Paris Agreement targets.

The CSRD stands out as a critical regulation in Europe, mandating detailed sustainability reporting for large companies starting in 2024. To support this, the European Sustainability Reporting Standards (ESRS) were developed as the mandatory framework that companies must use to meet CSRD requirements. These standards bring consistency and comparability to sustainability disclosures across industries, reinforcing Europe’s leadership in driving climate transparency.

Globally, other initiatives like the Science Based Targets Initiative (SBTi) encourage companies to align emissions reductions with climate science, while the Task Force on Climate-Related Financial Disclosures (TCFD) provides recommendations for consistent climate-related risk disclosures. Importantly, CSRD and ESRS will impact over 50,000 companies within the EU and more than 10,000 international companies that conduct business in the region, making them among the most significant sustainability regulations worldwide.

Reporting Frameworks - Setting the Standard

Effective emissions management relies on robust reporting. Here are the key frameworks guiding businesses:

Greenhouse Gas Protocol (GHG Protocol): The global standard for categorizing emissions (Figure 1.):

Scope 1: Direct emissions from owned or controlled operations (e.g., on-site fuel combustion).

Scope 2: Indirect emissions from purchased electricity, steam, heating, or cooling.

Scope 3: All other indirect emissions, such as those from the supply chain, product use, or disposal.

Carbon Disclosure Project (CDP): Encourages companies to disclose environmental data, providing transparency for investors and stakeholders.

ISO 14064 Standard: Focuses on quantifying and verifying GHG emissions to help organizations monitor their climate impact.

Global Reporting Initiative (GRI): The GRI provides globally recognized standards for sustainability reporting, helping organizations disclose their environmental, social, and governance (ESG) impacts transparently and consistently.

European Sustainability Reporting Standards (ESRS): The ESRS is the mandatory reporting framework for companies under the EU’s CSRD. It integrates with other frameworks to ensure companies provide comprehensive sustainability disclosures that comply with regulatory requirements.

Figure 1. Reporting Scopes 1-3 (based on GHG Protocol)

These frameworks provide clarity and structure for assessing environmental impact and aligning with global climate goals. For EU-based companies and international businesses operating in Europe, understanding and implementing ESRS is essential for meeting the regulatory standards set by CSRD.

Who Does This Apply To and When?

Regulations like the EU’s CSRD primarily target companies with significant environmental impacts, focusing on large businesses before expanding to smaller entities.

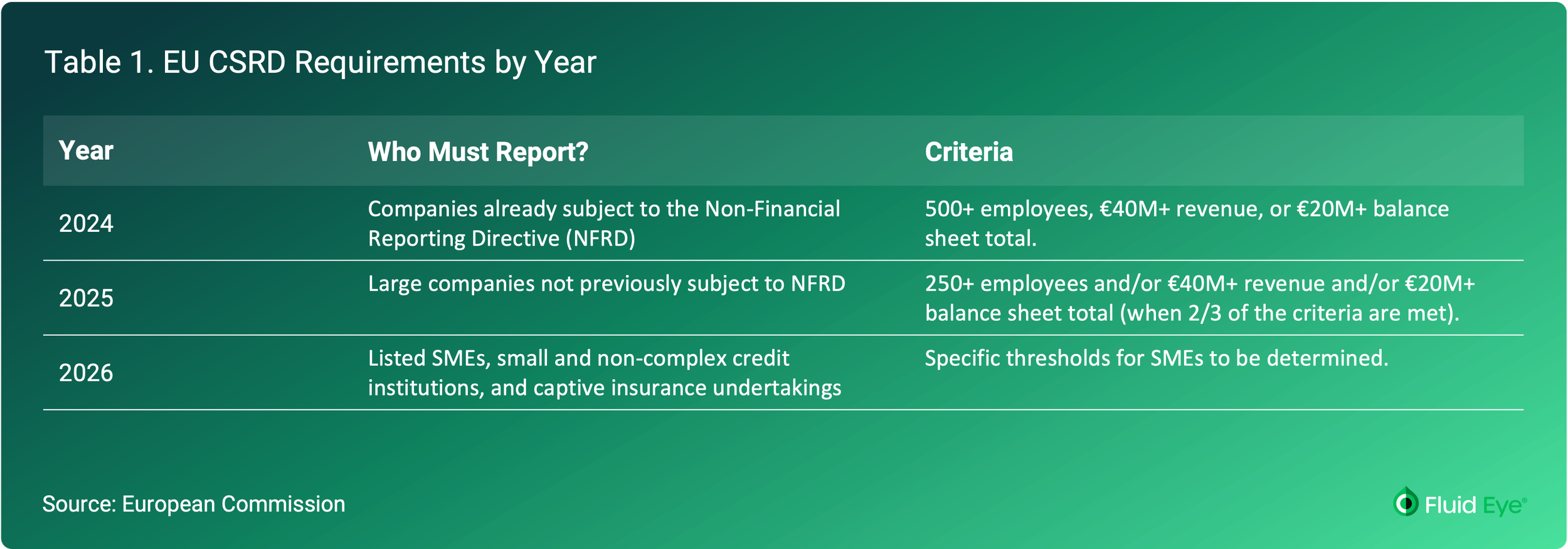

The CSRD introduces sustainability reporting in phases based on company size and structure as summarized in Table 1 below.

Table 1. EU CSRD Requirements by Year

Beyond Europe, the U.S. SEC’s anticipated climate disclosure rules are expected to come into effect in 2025, targeting public companies, while Asian markets like Japan and South Korea are rolling out frameworks aligned with their respective Net Zero goals. Here’s a timeline for key developments:

2024: Large European companies under NFRD begin reporting under CSRD.

2025: Expanded reporting to all large companies across the EU. SEC disclosure rules expected to take effect.

2026: Smaller entities, such as listed SMEs in the EU, begin compliance.

Businesses must prepare for increasing transparency and stricter compliance in the coming years. Preparing early ensures companies can meet deadlines while integrating sustainability into their operations strategically.

The Business Impact

Navigating emission regulations can feel daunting, but the benefits are significant:

Compliance builds trust. Transparency reassures investors, customers, and stakeholders.

Efficiency saves costs. Reporting drives operational insights, uncovering areas for improvement.

Innovation creates value. Proactive compliance encourages the adoption of new technologies and practices.

Three Key Takeaways

Understand the Frameworks: Familiarity with Scope 1, 2, and 3 emissions is essential for compliance and meaningful action.

Prepare for Deadlines: Early preparation for CSRD and other regulations reduces risks and ensures readiness.

Turn Compliance into Opportunity: Emissions reporting can enhance efficiency, cut costs, and strengthen sustainability efforts.

Navigating the Future Together

The evolving regulatory landscape doesn’t have to be overwhelming. By leveraging expert guidance and advanced solutions like Net Zero Lubrication model, businesses can confidently meet these challenges while advancing sustainability and operational excellence.

Stay tuned for our next article, where we’ll explore the hidden carbon footprint of lubricants and how to manage it effectively.

References and Sources

Disclaimers

The views expressed in this article are those of the authors. We regret for any unintentional errors, omissions, or misinterpretations.

Author: Mika Perttula (CEO - Fluid Intelligence Oy)

*** KEEP ON READING ABOUT NET ZERO LUBRICATION ***

Net Zero Lubrication is a strategic mindset and model helping industrial companies to maximize operational performance while minimizing fluid-based CO2 emissions and costs. This model is based on managing the entire lubrication lifecycle from Emissions Management and Fluid Performance Optimization perspectives in three stages - 1) Lubrication planning, 2) In-Service oil lifecycle and performance maximization, and 3) End-of-life waste oil management.

Continue reading Net Zero Lubrication articles to gain deeper insights how companies are optimizing their businesses to become more sustainably compliant, competitive, and profitable. Go to Net Zero Hub.